Examine This Report on Small Business Accountant Vancouver

Wiki Article

A Biased View of Virtual Cfo In Vancouver

Table of ContentsThe Main Principles Of Vancouver Tax Accounting Company The Facts About Small Business Accounting Service In Vancouver UncoveredThe Single Strategy To Use For Pivot Advantage Accounting And Advisory Inc. In VancouverExcitement About Small Business Accountant VancouverOur Outsourced Cfo Services PDFsThe Ultimate Guide To Tax Accountant In Vancouver, Bc

Here are some benefits to working with an accounting professional over a bookkeeper: An accountant can provide you a comprehensive view of your service's financial state, in addition to strategies as well as referrals for making economic decisions. At the same time, accountants are just accountable for recording economic purchases. Accounting professionals are called for to complete more education, qualifications as well as job experience than bookkeepers.

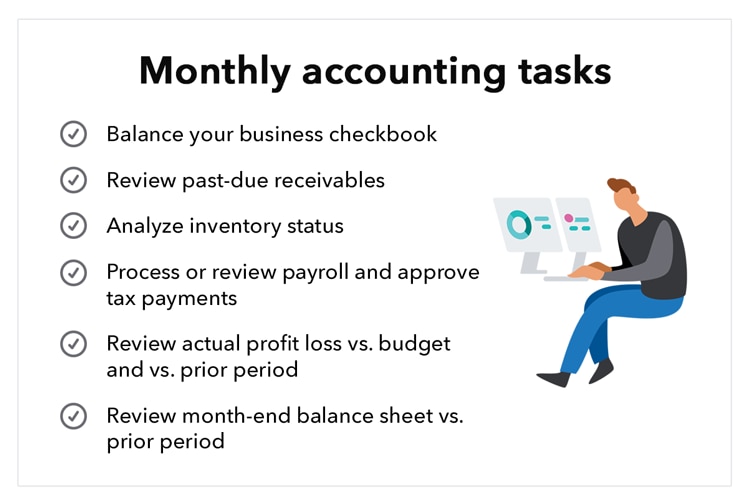

It can be challenging to evaluate the proper time to employ an audit specialist or accountant or to establish if you require one in any way. While lots of tiny organizations work with an accounting professional as a professional, you have a number of choices for dealing with monetary tasks. For example, some local business owners do their own bookkeeping on software application their accountant suggests or uses, giving it to the accountant on a weekly, monthly or quarterly basis for activity.

It may take some history study to locate a suitable accountant since, unlike accounting professionals, they are not needed to hold an expert accreditation. A solid endorsement from a relied on coworker or years of experience are important factors when working with an accountant.

Pivot Advantage Accounting And Advisory Inc. In Vancouver Fundamentals Explained

For local business, proficient cash money administration is a vital aspect of survival and growth, so it's important to collaborate with a monetary expert from the beginning. If you favor to go it alone, consider beginning with audit software as well as keeping your publications diligently approximately date. By doing this, should you need to hire an expert down the line, they will certainly have presence into the complete monetary history of your organization.

Some resource meetings were carried out for a previous variation of this article.

3 Easy Facts About Small Business Accounting Service In Vancouver Shown

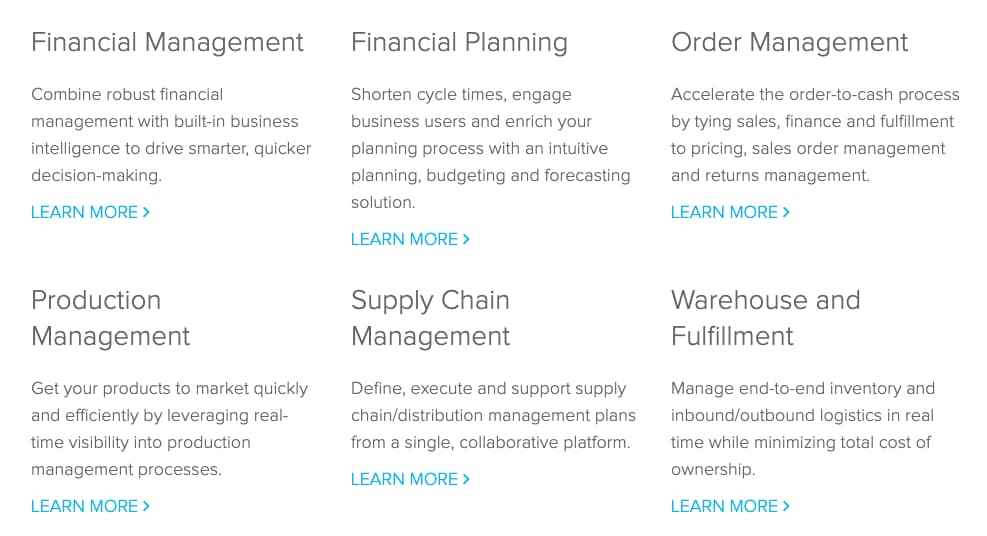

When it concerns the ins as well as outs of taxes, accountancy and also money, however, it never ever harms to have a skilled expert to look to for advice. A growing number of accountants are also taking care of things such as money flow projections, invoicing and also human resources. Ultimately, most of them are handling CFO-like functions.Small company proprietors can anticipate their accountants to aid with: Selecting business framework that's right for you is crucial. It affects how much you pay in tax obligations, the documents you need to file and your individual liability. If you're looking to convert to a various service framework, it might result in tax obligation repercussions and also various other issues.

Even companies that are the exact same size as well as market pay extremely various quantities for audit. These costs do not convert right into cash money, cpa income tax they are needed for running your organization.

Getting My Small Business Accountant Vancouver To Work

The ordinary price of bookkeeping solutions for tiny company varies for each and every distinct situation. Given that review bookkeepers do less-involved jobs, their rates are commonly less costly than accountants. Your financial solution fee relies on the job you need to be done. The typical monthly bookkeeping costs for a local business will increase as you add extra services and the jobs obtain tougher.You can record transactions and procedure payroll making use of on-line software application. Software program options come in all forms as well as dimensions.

The Buzz on Small Business Accountant Vancouver

If you're a brand-new service owner, don't neglect to element accounting expenses into your spending plan. Management costs as well as accounting professional fees aren't the only accountancy expenses.Your time is likewise beneficial as well as need to be thought about when looking at bookkeeping expenses. The time spent on audit jobs does not create profit.

This is not intended as lawful recommendations; for even more information, please click here..

Vancouver Tax Accounting Company - The Facts

:max_bytes(150000):strip_icc()/Accountingpolicies_color-6c5485e2b09541c697abd98d3094534c.png)

Report this wiki page